How a Flexible Network Model Helps Ensure Capacity for Shippers

In this article, we look at current factors impacting the transportation industry. We also discuss how the adaptability and underlying operational structure of carriers with flexible networks and access to entrepreneurial owner/operator teams can serve as a distinct advantage to shippers during periods of both increasing and declining market demand.

Market Conditions

As we begin 2023, the transportation industry remains highly tumultuous. From the lingering impacts of COVID-19 supply chain constraints to the economic volatility and unpredictability now associated with an inflationary economy, the market remains hard to navigate both for carriers and shippers.

If we look at the demand, supply, and cost of delivering transportation-related services, each has been heavily impacted since the start of the pandemic in early 2020. Starting with consumers’ shift from experiential spending in favor of a variety of goods when travel and events were cancelled and work life merged with home life across the country, the demand for space on trucks saw immense growth.

Meanwhile, the number of truck drivers across the U.S., already at a record low even prior to the pandemic, dwindled even further. The pandemic shutdown prevented trade schools from training a steady supply of new drivers. Other factors such as the introduction of the drug and alcohol clearinghouse, which while a positive long-term step for the industry, served to limit the number of new driver entries into the market during a critical time for the industry.

Carriers directly employing drivers and deploying their own fleets have seen their operation costs increase notably over the past year. This is attributable to a variety of factors including the need to increase driver salaries as a method of retention. With manufacturing production of new vehicles and replacement parts backlogged, maintenance costs also increased notably. Unprecedented fuel cost increases exacerbated by the War in Ukraine have added another level of complexity and concern for these carriers.

Shippers have also had a tough go of it, with last year proving to be a drain on the profitability of many companies, based on reported earnings by a variety of public companies. With many carriers and brokers saddled with the types of hard costs previously referenced and struggling to meet customer demand, spot prices rose to record high levels. Even those accustomed to certainty of their contracted freight agreements were often unable to obtain the truck capacity they required.

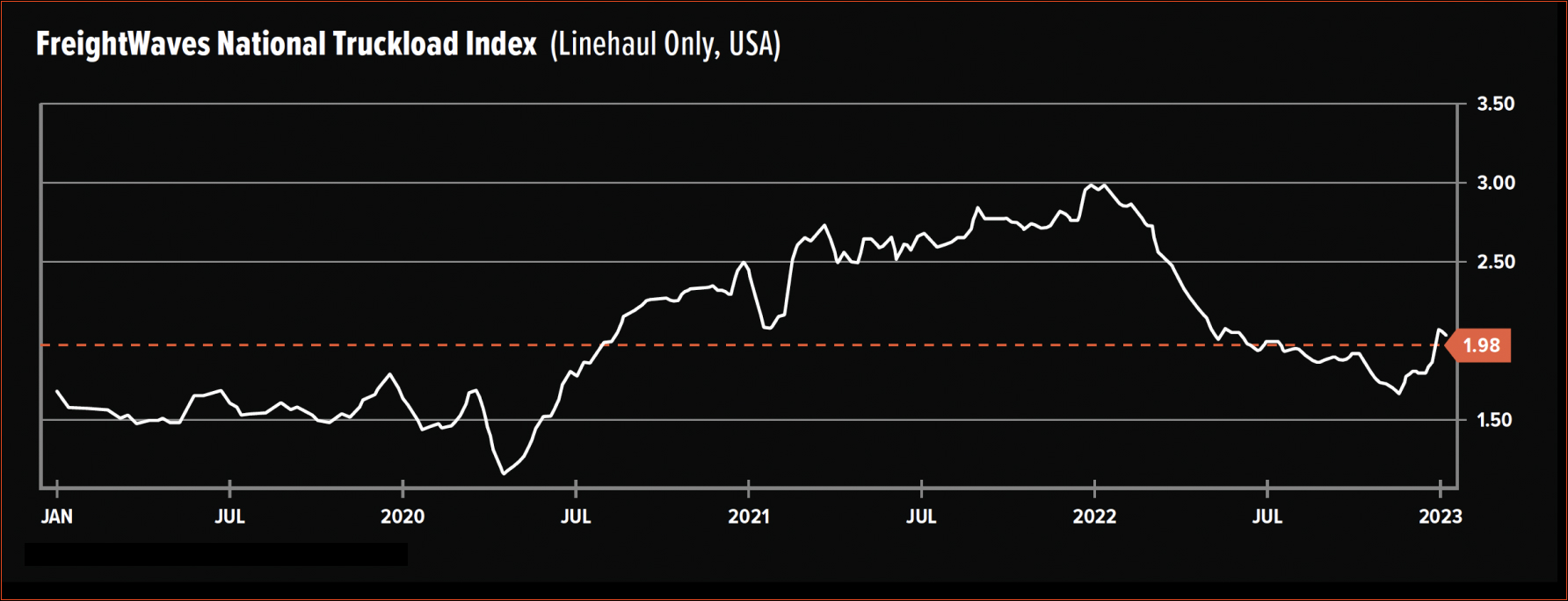

After peaking in early 2022, truckload spot rates fell to a low point last November but have since rebounded in Q1 2023.

GDP in the U.S. grew by over 5 percent in 2021 after a dismal 2020 and even with ongoing Fed actions on interest rates in 2022, was still on pace to achieve somewhere between 2.5 and 3 percent growth according to various sources. With inflation on a concerning course, the Fed taking interest rate action to curb it, and the stock market tumbling, consumer spending habits may be shifting. People may save more, invest in the down market and/or spend their hard-earned dollars on travel and leisure experiences such as concerts and other events after being deprived of participation in those activities for quite some time.

While this may contribute to a dip in demand for consumer goods, its overall impact on the transportation market remains a question. Many retailers are continuing to see a glut of inventory in their warehouses even after the holiday shopping season. Spot rates are now down notably but with congestion continuing to ease at ports and manufacturers and retail businesses working hard to produce and bring in the updated inventory that will help drive consumption moving forward, capacity demands over the next several months are likely to remain somewhat volatile and to a substantial extent, unpredictable.

The Flexible Network Model & Capacity

One of the advantages of being a carrier with access to a large pool of owner operators and teams in uncertain times like these is the flexibility it brings not only to the carrier itself but to its customers. Without the burden of owned vehicles and fulltime, company-employed drivers comes the ability to expand and contract capacity as needed, with speed and efficiency.

When demand is high, most shippers find they appreciate a carrier’s ability to flex the elasticity of its expandable network of independent contract drivers. And when demand is down, this same structure enables these carriers to offer highly competitive rates and a not pass extra overhead to the shippers because those prices do not need to absorb the type of carrying costs that asset-based carriers are forced to grapple with and pass along to keep their equipment and people running and working.

In volatile and unpredictable periods such as the one we are now experiencing in the industry, shippers who recognize these types of differences between carriers’ operational models stand to distinctly benefit. Furthermore, by working with carriers that have developed strong external transportation partner networks, they stand to experience even greater benefits during periods of strained capacity. The added resources brought via these cultivated relationships help a carrier address shipper needs in both its usual lanes as well as those it may need to accommodate due to special market or customer-driven circumstances across different modes as well.

Our company, Roadrunner, for example, is continuously buying contracted capacity on the spot market. This means that in addition to the drivers and trucks in our own organization, we can quickly provide extensive “flex” resources to our customers when needed via our Smart Network, while others in the industry simply cannot. And because we buy more on a contracted basis utilizing our best in class Emerge RFP tool, we are able to efficiently identify and secure spot rates that become available in the market at any given point in time. This type of carrier flexibility really pays off for shipping customers.

At Roadrunner, we recruit both experienced and newer drivers to our organization to join our Smart Team. A driver-centric mindset guides everything we do as we empower entrepreneurs to run their own businesses. We provide guidance and training based on industry best practices for vehicle maintenance, safety, and general business acumen. And we partner veteran driver/mentors with newer drivers to accelerate and assist with the learning curve. By implementing measures like these, we and other carriers can minimize driver vehicle fuel consumption and potential equipment-based down/idle time, all while maximizing driver lane mileage and earning power. How does this relate to delivering optimized customer capacity and quality service to our customers? Steps such as these help to ensure that 1) we as an organization have the capacity necessary when our customers most need it and 2) the vehicles transporting our customers’ goods will arrive at their destinations on time and incident-free.

Delivering industry-leading capacity while also ensuring a high level of quality and service is a tall order, and a focus on safety is a critical part of that equation. Beyond training, data shows that drivers also operate more safely and incident free when they have the proper rest, hygiene, and access to the kinds of quality facilities on the road that can deliver those necessities. Partnering with truck stops along metro-to-metro lanes to deliver these services, fuel discounts, and other benefits to our contracted drivers contributes to their safety on the road, their efficiency, and the overall management and availability of capacity for our customers.

Optimizing carrier capacity for shippers also requires having well-coordinated sales, recruitment, and operations teams that leverage data, forecasting tools, and strategic analysis to seize opportunities that exist in the market at any point in time. The ability to add new driver resources knowledgeably and efficiently or shift existing ones between lanes during low and high-volume periods can help cut transit times and ensure capacity is available when and where it is most needed. It also helps to limit driver idle time, which contributes to ongoing driver satisfaction. In turn, high retention levels keep skilled drivers in the network, keep that network flowing efficiently, and contribute to the sustained balance needed to consistently meet customer demand.

Roadrunner is the smart choice for shippers looking to move freight quickly and reliably at a great value. Our optimized, data-driven network moves direct from metro to metro without rail and with full visibility. As the most flexible nationwide LTL long haul carrier, we partner with experienced owner operators and teams drivers. More than 1,000 IC drivers leverage our network to empower their businesses and are motivated to deliver freight on time, intact, and damage free. With 1,250 employees, Roadrunner specializes in Smart Long Haul™, metro-to-metro shipping and has more direct routes between its 36 service centers than its traditional hub and spoke peers. Demonstrating a significant reduction in rail use, 100% of Roadrunner’s miles are run by drivers. Roadrunner’s Net Promoter Score (NPS), an indicator of customer willingness to recommend a company’s services, jumped 26%. Roadrunner was recognized by Newsweek as one of America’s Most Trustworthy Companies in 2022.

Lastly, technology is a critical and growing part of maintaining visibility into the business to drive these and other efficiencies. From a shipment’s initial pickup to its handling at our highly efficient cross-dock facilities all the way through delivery, we leverage Smart Technology to gain real-time insights into a wide range of shipment touch points. This helps us with overall network flow, enables us to keep customers well informed on their shipment status, and empowers us to take additional steps when needed to ensure shipments remain on time and are delivered without incident. The handheld devices, business software, Haul Now app, and other technology that we provide to our drivers assist them in contributing greater efficiency to our overall Smart Network as well, while also limiting their own dwell time. Deploying these types of tools helps drivers stay on schedule and serves to safeguard delivery of the loads entrusted to us by our valued shipping customers.

Advantages of Flexible Network Carriers

Flexibility and adaptability are more critical in the transportation market right now, than ever before. Carriers that do not carry the cost and risk associated with owning hard assets and directly employing human capital resources can consistently invest more heavily over time in areas such as operations and technology. These investments drive the type of quality and efficiency needed to deliver an optimal and reliable customer experience. Flexible Network carriers – those with access to entrepreneurial owner operators and teams – can scale capacity more quickly than their counterparts when needed to facilitate unforeseen circumstances, and to remain highly price competitive regardless of market conditions and demand.