Audit Committee

Roadrunner Transportation Systems, Inc. (the “Company”)

AUDIT COMMITTEE CHARTER

(Amended and Restated as of October 25, 2019)

Purpose

The purpose of the Audit Committee (the “Committee”) is to assist the Board of Directors in fulfilling its oversight responsibilities of the Company, including, but not limited to oversight of the following:

(a) The quality and integrity of the Company’s financial statements;

(b) The disclosure and financial reporting process, including disclosure controls and procedures;

(c) The Company’s compliance with legal and regulatory requirements;

(d) The qualifications, independence, and performance of the Company’s independent auditor;

(e) The performance of the Company’s internal audit function and overall risk management processes;

(f) Maintenance of internal controls regarding financial, accounting, and legal compliance; and

(g) To prepare an audit committee report as required to be included in the Company’s annual proxy statement by applicable rules and regulations of the Securities and Exchange Commission (“SEC”).

Composition

The Committee shall consist of three (3) or more members of the Board of Directors, each of whom is determined by the Board of Directors to be “independent” under the rules of the New York Stock Exchange and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934 adopted pursuant to the Sarbanes-Oxley Act. No member of the Committee shall receive directly or indirectly any consulting, advisory, or other compensatory fees from the Company or any of its subsidiaries other than director’s fees for service as a director of the Company, including reasonable compensation for serving on committees of the Board of Directors and regular benefits that other directors receive. In addition, no member of the Committee may be an affiliate of the Company or any subsidiary of the Company whether by way of being an officer or owning more than 10 percent of the Company’s voting securities. No member of the Committee may serve on the audit committee of more than three public companies, including the Company, unless the Board of Directors (1) determines that such simultaneous service would not impair the ability of such member to effectively serve on the Committee, and (2) discloses such determination in the Company’s annual proxy statement.

Qualifications

All members of the Committee shall be “financially literate,” as such qualification is interpreted by the Board of Directors (or must become financially literate within a reasonable period of time after his or her appointment). At least one (1) member must have “accounting or related financial management expertise,” as such qualifications are interpreted by the Board of Directors in its business judgment. At least one (1) member must be an “audit committee financial expert” as defined in the rules of the SEC. A person who satisfies the definition of an “audit committee financial expert” will also be presumed to have accounting or related financial management expertise. Committee members may enhance their familiarity with finance and accounting by participating in educational programs conducted by the Company or by an outside consultant.

Appointment and Removal

The members of the Committee shall be appointed annually by the Board of Directors based on nominations by the Company’s Nominating/Corporate Governance Committee. A member shall serve for one year, or until such member’s successor is duly elected and qualified or until such member’s earlier resignation or removal. The members of the Committee may be removed, with or without cause, by a majority vote of the Board of Directors.

Chairman

Unless a Chairman is annually elected by the full Board of Directors, the members of the Committee shall annually elect a Chairman by the majority vote of the full Committee membership. The Chairman shall serve for one year, or until such Chairman’s successor is duly elected and qualified or until such Chairman’s earlier resignation or removal. The Chairman will chair all regular sessions of the Committee and set the agendas for Committee meetings.

No Delegation to Subcommittees

In fulfilling its responsibilities, the Committee shall not be entitled to delegate any or all of its responsibilities to a subcommittee of the Committee.

Meetings

The Committee shall meet at least quarterly, or more frequently as circumstances dictate. The Chairman of the Committee or a majority of the members of the Committee may call meetings of the Committee. Any one or more of the members of the Committee may participate in a meeting of the Committee by means of a conference call or similar communication device by means of which all persons participating in the meeting can hear each other. An agenda for each Committee meeting, along with information and data that is important to each member’s understanding of the business to be conducted at such meeting, should be distributed to in advance of each meeting. The Committee shall also meet at least quarterly in executive session in the absence of Company management.

All non-management directors who are not members of the Committee may attend meetings of the Committee, but may not vote. In addition, the Committee may invite to its meetings any director, member of management of the Company, and such other persons as it deems appropriate in order to carry out its responsibilities. The Committee may also exclude from its meetings any persons it deems appropriate.

As part of its goal to foster open communication, the Committee shall periodically meet separately with any of the Company’s corporate executives, including the director of the Company’s internal auditing department, and the Company’s independent auditor to discuss any matters that the Committee or any of these individuals or entities believe would be appropriate to discuss privately. In addition, the Committee should meet with the Company’s independent auditor and management quarterly to review the Company’s financial statements and any other matter covered in this Charter.

Duties and Responsibilities

The Committee shall carry out the duties and responsibilities set forth below. These functions should serve as a guide with the understanding that the Committee may determine to carry out additional functions and adopt additional policies and procedures as may be appropriate in light of changing business, legislative, regulatory, legal, or other conditions. The Committee shall also carry out any other duties and responsibilities delegated to it by the Board of Directors from time to time related to the purposes of the Committee outlined in this Charter. The Committee may perform any functions it deems appropriate under applicable law, rules, or regulations, the Company’s bylaws, and the resolutions or other directives of the Board, including review of any certification required to be reviewed in accordance with applicable law or regulations of the SEC.

In discharging its oversight role, the Committee is empowered to study or investigate any matter of interest or concern that the Committee deems appropriate. In this regard and as it otherwise deems appropriate, the Committee shall have the authority, without seeking Board approval, to engage and obtain advice and assistance from outside legal and other advisors as it deems necessary to carry out its duties. The Committee also shall have the authority to receive appropriate funding, as determined by the Committee, in its capacity as a committee of the Board of Directors, from the Company for the payment of compensation to any accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review, or attest services for the Company; to compensate any outside legal or other advisors engaged by the Committee; and to pay the ordinary administrative expenses of the Committee that are necessary or appropriate in carrying out its duties.

The Committee shall be given full access to the Company’s internal audit group, Board of Directors, corporate executives, employees, and independent auditor as necessary to carry out these responsibilities. All Company employees are required to cooperate with Committee investigations, including, but not limited to, producing all requested documents and participating in interviews. Any failure to cooperate shall be grounds for discipline by the Board, including, but not limited to, termination for cause, in the sole discretion of the Board. While acting within the scope of its stated purpose, the Committee shall have all the authority of the Board of Directors, except as otherwise limited by applicable law.

The Committee shall obtain input from management representatives as necessary to review the accuracy of public disclosures, including, with respect to: (i) accounting policies, including the recognition and calculation of any nonmonetary transactions; (ii) operations, enterprise risks, and compliance matters that may have a material impact on the Company’s operational performance, financial health, balance of risk, stability, and liquidity; and (iii) any other material matters required to be disclosed under state and federal securities laws and regulations.

Notwithstanding the foregoing, the Committee is not responsible for certifying the Company’s financial statements or guaranteeing the independent auditor’s report. The fundamental responsibility for the Company’s financial statements and disclosures rests with management and the independent auditor. It also is the job of the Chief Executive Officer and senior management, rather than that of the Committee, to assess and manage the Company’s exposure to risk.

Documents/Reports Review

1. Discuss with management, the independent auditor, the Controller, the Chief Compliance Officer, and the Chief Audit Executive, prior to public dissemination, the Company’s annual audited financial statements and quarterly financial statements, including the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and discuss with the independent auditor the matters required to be discussed by Statement of Auditing Standards No. 61 and PCAOB Auditing Standards No. 1301.

2. Discuss with management, the independent auditor, the Controller, the Chief Compliance Officer, and the Chief Audit Executive, prior to the Company’s filing of any quarterly or annual report, (a) whether any significant deficiencies in the design or operation of internal control over financial reporting exist that could adversely affect the Company’s ability to record, process, summarize, and report financial data; (b) the existence of any material weaknesses in the Company’s internal control over financial reporting; and (c) the existence of any fraud, whether or not material, that involves management or other employees who have a significant role in the Company’s internal control over financial reporting.

3. Discuss with management, the independent auditor, the Controller, the Chief Compliance Officer, and the Chief Audit Executive the Company’s earnings press releases (paying particular attention to the use of any “pro forma” or “adjusted” or other non-GAAP information), as well as financial information and earnings guidance provided and the type of presentations made to analysts and rating agencies. The Committee’s discussion in this regard may be general in nature (i.e., discussion of the types of information to be disclosed and the type of presentation to be made) and need not take place in advance of each earnings release or each instance in which the Company may provide earnings guidance.

4. Discuss with management, the independent auditor, the Controller, the Chief Compliance Officer, and the Chief Audit Executive the Company’s major financial risk exposures, the guidelines and policies by which risk assessment and management is undertaken, and the steps management has taken to monitor and control risk exposure.

5. Review and discuss with management, the independent auditor, the Controller, the Chief Compliance Officer, and the Chief Audit Executive, as necessary, prior to the Company’s filing of any current, quarterly or annual report the accuracy of such public disclosures, including, with respect to: (i) accounting policies, including the recognition and calculation of any nonmonetary transactions; (ii) operations, enterprise risks, and compliance matters that may have a material impact on the Company’s operational performance, financial health, balance of risk, stability, and liquidity; and (iii) any other material matters required to be disclosed under state and federal securities laws and regulations.

6. The Committee shall annually review a report listing all trades in Company securities engaged in by each Section 16 officer during the preceding calendar year.

Independent Auditors

1. Directly appoint, retain, compensate, evaluate, and terminate any accounting firm engaged by the Company for the purpose of preparing or issuing an audit report or performing other audit, review, or attest services for the Company and, in its sole authority, approve all audit engagement fees and terms as well as all non-audit engagements with such accounting firm.

2. Oversee the work of any accounting firm engaged by the Company for the purpose of preparing or issuing an audit report or performing other audit, review, or attest services for the Company, including resolving any disagreements between management and the independent auditor regarding financial reporting.

3. Pre-approve, or adopt procedures to pre-approve, all audit, audit related, tax, and other services permitted by law or applicable SEC regulations (including fee and cost ranges) to be performed by the independent auditor. Any pre-approved services that will involve fees or costs exceeding pre-approved levels will also require specific pre-approval by the Committee. Unless otherwise specified by the Committee in pre-approving a service, the pre-approval will be effective for the 12-month period following pre-approval. The Committee will not approve any non-audit services prohibited by applicable SEC regulations or any services in connection with a transaction initially recommended by the independent auditor, the purpose of which may be tax avoidance and the tax treatment of which may not be supported by the Internal Revenue Code and related regulations.

4. To the extent it deems it appropriate, delegate pre-approval authority to the Chairman of the Committee or any one or more other members of the Committee provided that any member of the Committee who has exercised any such delegation must report any such pre-approval decision to the Committee at its next scheduled meeting. The Committee will not delegate the pre-approval of services to be performed by the independent auditor to management.

5. Require that the independent auditor, in conjunction with the Chief Financial Officer, be responsible for seeking pre-approval for providing services to the Company and that any request for pre-approval must inform the Committee about each service to be provided and must provide detail as to the particular service to be provided.

6. Inform each accounting firm engaged for the purpose of preparing or issuing an audit report or to perform audit, review, or attest services for the Company that such firm shall report directly to the Committee.

7. Keep the Company’s independent auditors informed of the Committee’s understanding of the Company’s relationships and transactions with related parties that are significant to the Company; and review and discuss with the Company’s independent auditors the auditors’ evaluation of the Company’s identification of, accounting for, and disclosure of its relationships and transactions with related parties, including any significant matters arising from the audit regarding the Company’s relationships and transactions with related parties.

8. Review and evaluate, at least annually, the qualifications, performance, and independence of the independent auditor, including the lead audit partner. In conducting its review and evaluation, the Committee should do the following:

(a) At least annually, obtain and review a report by the Company’s independent auditor describing (i) the auditing firm’s internal quality-control procedures; (ii) any material issues raised by the most recent internal quality-control review, or peer review, of the auditing firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the auditing firm, and any steps taken to deal with any such issues; and (iii) the auditor’s independence and all relationships and services provided by or between the independent auditor and the Company.

(b) Discuss with management, the Controller, the Chief Compliance Officer, and the Chief Audit Executive, the timing and process for implementing the rotation of the lead (or coordinating) audit partner, the concurring (or reviewing) audit partner, and any other active audit engagement team partner, and consider whether there should be regular rotation of the audit firm itself.

(c) Confirm with the independent auditor that the lead audit partner, the concurring audit partner, and each other active audit engagement team partner satisfies the rotation requirements of Rule 2-01(c)(6) of Regulation S-X.

(d) Take into account the opinions of management and the Company’s internal auditor (or other personnel responsible for the internal audit function) in assessing the qualifications, performance, and independence of the independent auditor.

Financial Reporting Process

1. In consultation with the independent auditor, management, and the internal auditor, review the integrity of the Company’s financial reporting processes, both internal and external. In that connection, the Committee should obtain and discuss with management and the independent auditor reports from management and the independent auditor regarding (a) all critical accounting policies and practices, including the recognition and calculation of any nonmonetary transactions, to be used by the Company and the related disclosure of those critical accounting policies under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; (b) analyses prepared by management and/or the independent auditor setting forth significant financial reporting issues and judgments made in connection with the preparation of the financial statements; (c) all alternative treatments of financial information within generally accepted accounting principles that have been discussed with the Company’s management, the ramifications of the use of the alternative disclosures and treatments, and the treatment preferred by the independent auditor; (d) major issues regarding accounting principles and financial statement presentations, including any significant changes in the Company’s selection or application of accounting principles; (e) major issues as to the adequacy of the Company’s internal controls and any specific audit steps adopted in light of material control deficiencies; (f) issues with respect to the design and effectiveness of the Company’s disclosure controls and procedures, management’s evaluation of those controls and procedures, and any issues relating to such controls and procedures during the most recent reporting period; (g) the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on the financial statements of the Company; (h) any significant matters arising from any audit, including any audit problems or difficulties, whether raised by management, the internal auditor, or the independent auditor, relating to the Company’s financial statements; and (i) any other material written communications between the independent auditor and the Company’s management, including any “management” letter or schedule of unadjusted differences.

2. Review periodically the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on the financial statements of the Company.

3. Review with the independent auditor any audit problems or difficulties encountered and management’s response thereto. In this regard, the Committee will regularly review with the independent auditor (a) any audit problems or other difficulties encountered by the auditor in the course of the audit work, including any restrictions on the scope of the independent auditor’s activities or on access to requested information, and any significant disagreements with management and (b) management’s responses to such matters. Without excluding other possibilities, the Committee may review with the independent auditor (i) any accounting adjustments that were noted or proposed by the auditor but were “passed” (as immaterial or otherwise), (ii) any communications between the audit team and the audit firm’s national office respecting auditing or accounting issues presented by the engagement, and (iii) any “management” or “internal control” letter issued, or proposed to be issued, by the independent auditor to the Company.

4. Advise management, the internal audit department, and the independent auditor that they are expected to provide the Committee a timely analysis of any significant financial reporting issues and practices.

5. Obtain from the independent auditor assurance that the audit of the Company’s financial statements was conducted in a manner consistent with Section 10A of the Securities Exchange Act of 1934, which sets forth procedures to be followed in any audit of financial statements required under the Securities Exchange Act of 1934.

6. Request the internal auditor to provide the Committee with summaries and, as appropriate, the significant reports to management prepared by the internal auditor and any management responses thereto.

7. Discuss the scope of the annual audit and review the form of the opinion the independent auditor proposes to render.

8. Review and discuss with management and the independent auditor the responsibilities, budget, and staffing of the Company’s internal audit function and any appointment or replacement of the internal auditor or the director of the internal auditing department.

Legal Compliance/General

1. Review at least quarterly with the Company’s legal counsel, the Controller, the Chief Compliance Officer, and/or the Chief Audit Executive any significant legal, compliance, operational, or regulatory matters that may have a material effect on the Company’s financial statements or the Company’s business or compliance policies, including material notices to or inquiries received from governmental agencies.

2. Discuss at least quarterly with management, the independent auditor, the Controller, the Chief Compliance Officer, and/or the Chief Audit Executive the Company’s guidelines and policies with respect to risk assessment and risk management. The Committee will discuss the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures.

3. Set clear hiring policies for employees or former employees of the independent auditor. At a minimum, these policies will provide that any public accounting firm may not provide audit services to the Company if the Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, Controller, or any person serving in an equivalent position for the Company was employed by the audit firm and participated in any capacity in the audit of the Company within one year of the initiation of the current audit.

4. Establish procedures for (a) the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters; and (b) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

5. The Controller, Chief Compliance Officer, and/or Chief Audit Executive shall provide, where appropriate, a report regarding the matters contemplated in this section (Legal Compliance/General) in advance of each Committee meeting including, for example, the status of the review into any complaints received under item 4 above.

6. The Chief Audit Executive shall make quarterly reports to the Committee and annual reports to the full Board regarding the state of the Company’s internal controls and compliance policies, programs, and performance, including, but not limited to, the Company’s compliance with applicable accounting rules and regulations,

7. The Committee shall provide reports to the Board with respect to any actions taken or recommendations made by the Committee.

Reports

1. Prepare an audit committee report as required to be included in the Company’s proxy statement, pursuant to and in accordance with applicable rules and regulations of the SEC.

2. Report regularly to the full Board of Directors. In this regard, the Committee will review with the full Board any issues that arise with respect to the quality or integrity of the Company’s financial statements, the Company’s compliance with legal or regulatory requirements, any material complaints the Committee determined it should take action or resolve under the Company’s Whistleblower Policy, the performance and independence of the Company’s independent auditor, and the performance of the internal audit function.

3. The Committee shall provide such recommendations as the Committee may deem appropriate. The report to the Board of Directors may take the form of an oral report by the Chairman or any other member of the Committee designated by the Committee to make such report.

4. The Committee shall report to the Compensation Committee annually regarding the CEO and CFO’s contribution to the Company’s culture of ethics and compliance and their effectiveness and dedication to ensuring the Company’s compliance with applicable laws, rules, and regulations.

5. Maintain minutes or other records of meetings and activities of the Committee.

Compliance Oversight

1. The Committee shall be responsible for the oversight of the Company’s compliance policies, including matters reported pursuant to the Company’s Whistleblower Policy, as well as complaints received by the Company regarding accounting, internal accounting controls, auditing matters, or any other topic covered by the Company’s compliance policies.

Committee Functioning

In conjunction with the Nominating/Corporate Governance Committee of the Board of Directors, the Committee will give consideration to the qualifications and criteria for membership of the Committee; the appointment and removal of members of the Committee; and the structure and operations of the Committee.

Annual Performance Evaluation

The Committee will perform a review and evaluation, at least annually, of the performance of the Committee, including reviewing the compliance of the Committee with this Charter. The Board of Directors shall participate in such annual evaluation of the Committee. In addition, the Committee will review and reassess, at least annually, the adequacy of this Charter and recommend to the Board of Directors any improvements to this Charter that the Committee considers necessary or valuable. The Committee will conduct such evaluations and reviews in such manner as it deems appropriate.

Limitation of Audit Committee’s Role

With respect to the foregoing responsibilities and processes, the Committee recognizes that the Company’s financial management, including the internal audit staff, as well as the independent auditor have more time, knowledge, and detailed information regarding the Company than do Committee members. Consequently, in discharging its oversight responsibilities, the Committee will not provide or be deemed to provide any expertise or special assurance as to the Company’s financial statements or any professional certification as to the independent auditor’s work.

While the Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Committee to plan or conduct audits or to determine that the Company’s financial statements and disclosures are complete and accurate and are in accordance with generally accepted accounting principles and applicable rules and regulations. These are the responsibilities of management and the independent auditor. It also is not the duty of the Committee to conduct investigations or to assure compliance with laws and regulations and the Company’s internal policies and procedures.

Publicly Available

This Charter shall be posted on the Company’s website.

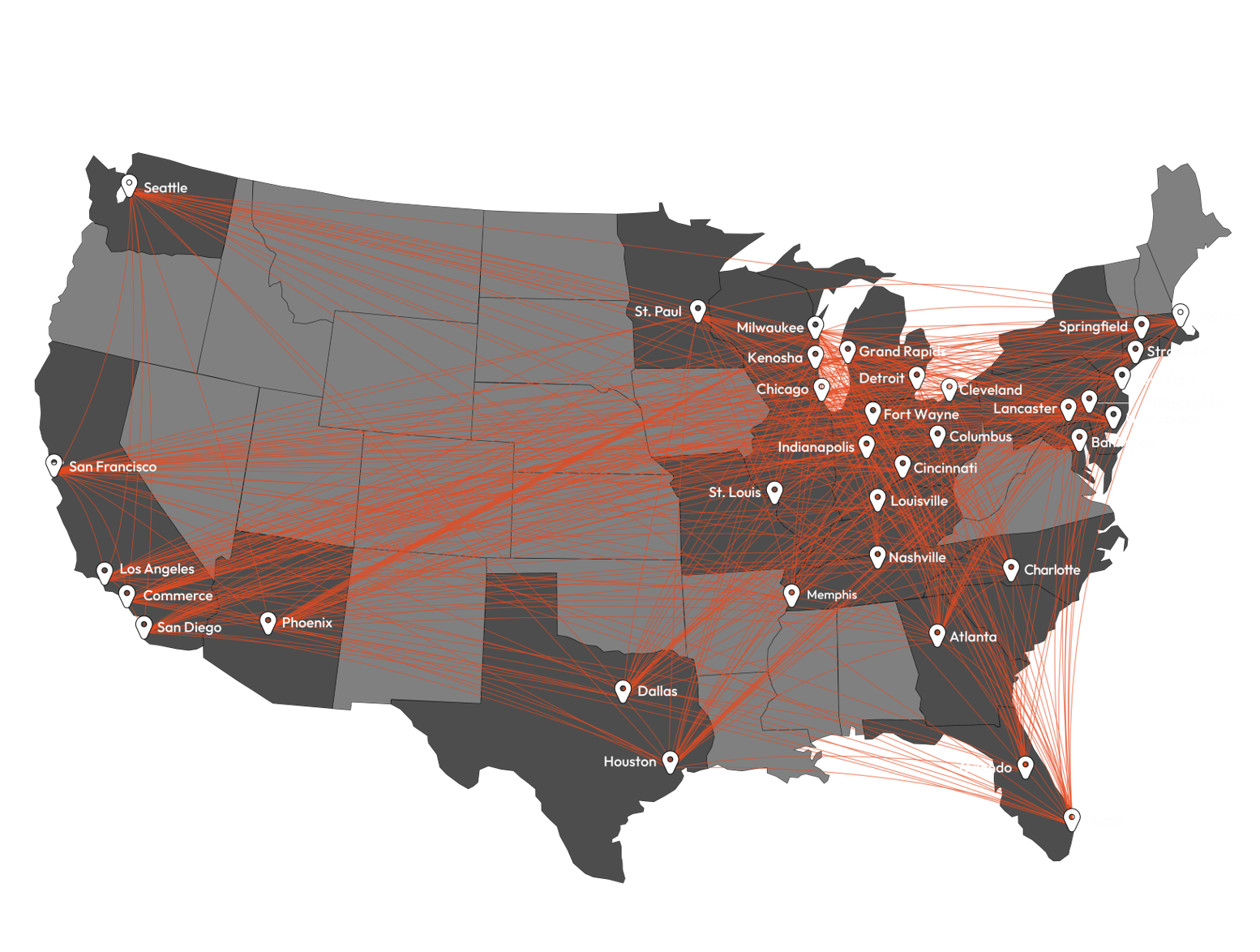

Our long haul, nationwide LTL freight lanes offer service to shippers in all major metros of the US. View our long haul maps here.

Regional lanes between major cities offer high-quality service and efficient transit times. View our regional transit maps here.

Next day delivery is offered in the major metro areas surrounding our brick and mortar facilities. View our next day delivery area here.

Find a Service Center